This research was sponsored by the MIT Center for Coordination

Science. I would like to thank Oliver Hart, Tom Malone, Birger

Wernerfelt, an anonymous associate editor and referees, and seminar

participants at the ORSA/TIMS Joint National Meeting (1992), the

Coordination Science Seminar Series and the Third Workshop on

Information Systems and Economics for helpful comments and insights.

Although there is good reason to expect that the growth of information

work and information technology will significantly affect the

trade-offs inherent in different structures for organizing work,

the theoretical basis for these changes remains poorly understood.

This paper seeks to address this gap by analyzing the incentive

effects of different ownership arrangement in the spirit of the

Grossman-Hart-Moore (GHM) incomplete contracts theory of the firm.

A key departure from earlier approaches is the inclusion of a

role for an "information asset", analogous to the

GHM treatment of property. This approach highlights the organizational

significance of information ownership and information technology.

For instance, using this framework, one can determine when 1)

informed workers are more likely to be owners than employees of

firms, 2) increased flexibility of assets will facilitate decentralization,

and 3) the need for centralized coordination will lead to centralized

ownership. The framework developed sheds light on some of the

empirical findings regarding the relationship between information

technology and firm size and clarifies the relationship between

coordination mechanisms and the optimal distribution of asset

ownership. While many implications are still unexplored and untested,

building on the incomplete contracts approach appears to be a

promising avenue for the careful, methodical analysis of human

organizations and the impact of new technologies.

2. Information and asset ownership

3.2 What is the impact of making information alienable or contractible?

3.3 Do smaller firms provide better incentives for exploiting information?

3.4 Are flexible assets more appropriate for informed agents?

3.5 How does "coordination information" affect the distribution and ownership of production assets?

4.2 Comparison with empirical evidence

4.3 Comparison with related literature

Information technology has the potential to significantly affect

the structure of organizations. However, the nature of these changes

is still being debated. While the heuristics and intuition that

managers have applied for years provide some guidance, the changes

enabled by information technology are potentially so radical that

past experience may not prove a trustworthy guide. Meanwhile,

researchers using field studies examining the link between investments

in information technology and changes in organizational structure

have come to diverse and often contradictory conclusions (see

Crowston & Malone (1988) for a review). Econometric work has

been able to generalize some of the findings of the case studies,

but can only claim to have found correlations, not causal links

(Brynjolfsson, Malone, Gurbaxani, et al., 1991a). Managers and

researchers each suffer from the lack of robust theoretical models

that provide sharp, testable predictions.

The interdisciplinary field of coordination science has emerged in part to help address this gap. For instance, Malone and colleagues (Malone & Smith, 1988; Malone, Yates & Benjamin, 1987), have modeled different structures, such as firms and markets, for coordinating intelligent agents. This has enabled specific predictions of the effects of changes in information technology on the flexibility, production and coordination costs of these structures. However, many important issues concerning information technology and the boundaries of the firm are beyond the scope of these models. In this paper, I pursue a new approach to address the following questions:

1) How does the location of information affect incentives and ownership structure?

2) What is the impact of making information alienable or contractible?

3) Do smaller firms provide better incentives for exploiting information?

4) Are flexible assets more appropriate for informed agents?

5) How does "coordination information" affect the optimal

distribution and ownership of production assets?

While many of these questions fall under the traditional purview

of economics, progress has been hampered by the lack of an adequate

economic theory of the firm. Ironically, despite the central role

of the firm in economics, neoclassical economics traditionally

treats the firm as little more than a black box "production

function". Developments in principal-agency theory have

given some insight into the incentive mechanisms used inside

firms, and by extension, the role of information and information

technology. However, because the same models apply equally well

to contracts between firms, agency theory by itself cannot

explain the boundaries of firms or the relative advantages of

different institutional or ownership structures (Hart, 1989) .

Transaction cost economics (Williamson, 1985) directly addresses

the question of what determines firm boundaries. The insights

of this approach have been useful in describing the impact of

information technology on firm boundaries (Brynjolfsson, Malone

& Gurbaxani, 1988; Malone, Yates & Benjamin, 1987). However,

while it is difficult to develop a theory of IT's impact

on firm boundaries using agency theory, it is almost too easy

using transaction cost economics. As Fischer (1977, n. 5) put

it: "There is a suspicion that almost anything can be rationalized

by invoking suitably specified transaction costs."

More recently, an economic theory of the firm has emerged that

combines the insights of transaction cost economics regarding

the importance of bounded rationality and contracting costs with

the rigor of agency theory. The new theory focuses on the way

different structures assign property rights to resolve the issues

that arise when contracts are incomplete. This provides a basis

for defining different organizational structures by the ownership

and control of key assets. Grossman, Hart and Moore (Grossman

& Hart, 1986; Hart & Moore, 1990) pioneered this approach

and its relationship to earlier approaches has been lucidly documented

by Hart (1989).[1]

In this paper, I build on the insights of the property rights

approach to the theory of the firm to clarify the mechanisms by

which information technology can be expected to affect the organization

of economic activity. Although I change some of the assumptions

and come to new conclusions, this paper can perhaps best be viewed

as an application of the Hart-Moore framework which focuses on

information, whether embodied in humans or artifacts. In particular,

I will consider the incentive effects of various allocations of

"information assets" as well as physical assets. This

approach is particularly appropriate given the increasing importance

of information in the economy. In addition, by considering the

role of incentives, it is possible to answer some long-standing

questions regarding the link between stylized coordination mechanisms

and real-world institutions like firms and markets. For instance,

this approach facilitates the analysis of cases that illuminate

each of the five questions posed above.

The remainder of the paper is organized as follows. Section two

describes the basic assumptions behind the property rights approach

and sets up the framework. Section three uses this framework to

explicitly treat information as an asset. This facilitates the

investigation of a variety of different organizational forms under

different distributions of information, levels of asset specificity

and coordination mechanisms. In section four, I summarize the

conclusions of the paper and compare and contrast it to related

literature.

2. Information and asset ownership

2.1 Asset Ownership and Incentives

Before examining specific models of information technology and

information work, it is worth sketching the basic tenets of the

property rights framework.

Begin by considering one of the simplest sorts of organization,

an arrangement between a principal and an agent hired to accomplish

some task. As principal-agent theory has long argued, appropriate

incentives must be provided for the agent. In general, because

the principal cannot directly measure the effort level of the

agent, incentives need to be provided by making the agent's

pay partially contingent on performance. An example is the commission

that a sales agent often receives. A basic conclusion of the theory

is that agency problems can be mitigated, and sometimes even solved,

by promising the agent a sufficient share of the output produced.

However, problems arise when it is not possible to specify clear

performance measures in advance. For instance, the owner of the

firm may have insufficient information to prespecify the decision-making

activities of the firm's managers (after all, that's presumably

what they were hired to do). Simply linking management

pay to sales or even profits would encourage managers to inappropriately

shift resources away from R&D and maintenance. The solution

prescribed by agency theory calls for a comprehensive contract

that considers the marginal value of all possible activities of

the agents and the marginal cost to the agents in all possible

states of the world, and the ability of the principal to commit

to pay the appropriate compensation for each outcome (Hart &

Holmstrom, 1987). Lacking such a comprehensive contract, incentives,

and therefore production, will be suboptimal.

A key tenet of the GHM approach is that unlike the contracts typically

analyzed by agency theory, real world contracts are almost always

"incomplete", in the sense that there are inevitably

some circumstances or contingencies that are left out of the contract,

because they were either unforeseen or simply too expensive to

enumerate in sufficient detail. For instance, the level of intangible

"quality" of a manufactured good, the level of "care"

used in maintaining a piece of equipment, or the thought process

used in generating a creative insight are all aspects of a contract

that are often too costly, if not impossible, to include in a

contract. This is a natural consequence of the bounded rationality

of the parties. Each of the parties will have certain rights under

the contract, but its incompleteness means that there will remain

some "residual rights" that are not specified in the

contract. When these rights pertain to the use of an asset, the

institution which allocates these residual rights of control is

property ownership. All rights to the asset not expressly assigned

in the contract accrue to the person called the "owner"

of the asset. [2]For example, if a machine rental contract says nothing

about its maintenance protocol, then it is the machine's

owner who retains the right to decide.

The allocation of the residual rights of control will have an

important effect on the bargaining position of the parties to

the contract after they have made investments in their relationship.

In the absence of comprehensive contracts, property rights largely

determine which ex post bargaining positions will prevail. In

particular, a party that owns at least some of the essential assets

will be in a position to reap at least some of benefits from the

relationship which were not explicitly allocated in the contract,

by threatening to withhold the assets otherwise. A party who does

not control any assets, and whose cooperation is unnecessary to

the harvesting of value, must rely on the letter of the contract

or the goodwill of the assets' owner to share in the output. As

a result, an agent who controls no essential assets risks going

unpaid for work which is not specifically described in an explicit

contract. In contrast, the agent who controls assets that are

essential to the relationship can "veto" any allocation

of the residual rewards which is not considered sufficiently favorable.

Thus, the ownership of assets that are essential to production

and the receipt of the residual income stream go hand in hand.

According to this view, the dilemma of providing incentives to

agents when comprehensive contracts are infeasible can be mitigated

if those agents are assured a significant share of the output

they produce by providing them with the ex post bargaining power

inherent in asset ownership. Based on this principle, Grossman,

Hart and Moore have derived a theory of vertical and lateral integration

with implications for industry structure and the optimal size

of firms.

The distinction between "markets" and "hierarchies"

emphasizes that production can be organized within one firm or

among several firms, depending on whether the principal means

of production are controlled by a single person (or group), or

distributed among several. Hart and Moore (1990) develop a useful

framework and notation for examining how changes in the distribution

of asset ownership affects the incentives of the individuals who

work, directly or indirectly, with those assets and they establish

a number of propositions regarding the optimality of different

ownership structures. I will use a variant of this framework to

capture the essential properties of the relationship between information

and ownership and to provide a useful tool for more broadly examining

the organizational implications of different distributions of

information among individuals.

Application of the framework requires a number of assumptions,

which are reproduced formally in the appendix. Because ownership

is only important to the extent that actions are uncontractible,

all actions in the model are assumed to be uncontractible, with

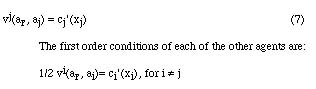

incentives influenced only by asset ownership. ![]() and the marginal value generated

by i's actions when he is in a coalition with a subset S of other

agents is denoted vi(S,A(S)|x), where A(S) is the set of all assets

owned by the coalition and x is the vector of actions taken by

the coalition's members. To decide how the total value generated

by a group of agents working together will be apportioned, Hart

and Moore suggest the use of the Shapley value.[3]

and the marginal value generated

by i's actions when he is in a coalition with a subset S of other

agents is denoted vi(S,A(S)|x), where A(S) is the set of all assets

owned by the coalition and x is the vector of actions taken by

the coalition's members. To decide how the total value generated

by a group of agents working together will be apportioned, Hart

and Moore suggest the use of the Shapley value.[3]

This amounts to paying each agent an amount equal to his contribution

to each potential coalition multiplied by the probability that

he will be in any given coalition. Although the Shapley value

is traditionally used to analyze cooperative bargaining (Shapley,

1953), Gul (1989) provides a detailed non-cooperative bargaining

justification for this assumption. In any event, the exact rule

for division of the surplus will generally have no qualitative

effect on the results as long as each agent's share of output

is positively correlated with his access to essential assets.

2.3 Information as an "Asset"

But what are "assets"? Assets are relevant in Hart and

Moore insofar as they affect marginal product; the marginal value

of an agent's actions are greater when he has access to more assets:

![]()

They specifically limit the interpretation of the term "asset"

to non-human assets like machines, factories or customer lists

because they are alienable, and thus can change "ownership".

Similarly, much of economic theory and practice has focused on

the role of physical capital and tangible assets to the detriment

of human capital and intangibles like information, knowledge and

skills.

In contrast, Simon has long argued for a greater emphasis on these

intangible assets:

My central theme has been that the main productive resource in an economy are programs -- skills, if you prefer -- that in the past have been partly frozen into the design of machines, but largely stored in the minds of men.(Simon, 1982)

Given the continuing information explosion, the role of "intellectual

capital" is becoming more significant. As Drucker (1992)

recently put it:

In this society, knowledge is the primary resource for

individuals and for the economy overall. Land, labor and capital

-- the economist's traditional factors of production -- do not

disappear, but they become secondary.

Quantifying the importance of intellectual capital is difficult,

given its intangible nature. But as Wriston points out, that does

not make it any less important:

To enter a business, the entrepreneur in the information age often

needs access to knowledge more than he or she needs large sums

of money. To write a software program that might make its author

millions of dollars may require only a relatively trivial investment

[in physical capital], compared to the investment needed to enter,

say, a manufacturing business producing a comparable stream of

income. It is the knowledge capital accumulated in the software

writer's head or in the documentation or on the disks that makes

possible the new program. This capital is substantial and very

real. And it does not show up with any clarity in the numbers

economists customarily quote about capital formation. (Wriston,

1992, p.102)

The dilemma of assessing the value of intellectual capital can

be addressed by focusing on the income it produces, rather than

the traditional approach of estimating the investments made. Using

this procedure, Jorgenson and Fraumeni (1992) recently concluded

that the stock of human capital is ten times greater than previous

estimates, dwarfing other kinds of investment.

Just as Jorgenson and Fraumeni empirically define human capital

by the income that this "asset" produces, we can adapt

Hart and Moore's (1990) framework to include human capital as

an asset that affects agents' marginal products when they have

access to it. This requires us to depart from their assumption

that only tradable commodities can be "assets". However,

it facilitates a number of insights into organizational form.

Given the qualitative and quantitative importance of information,

knowledge and skills in the modern economy, I will focus on the

application of the incomplete contracting paradigm to this type

of "asset". I will argue that the information that an

agent knows can be critical to his productivity and incentives,

suggesting that human capital can be treated on a par with physical

capital. Accordingly, in the examples that follow, I will treat

the information that the agent knows as an "asset" that

he "owns". This approach enables the analysis of how

the inalienability of some assets, such as knowledge, affects

the optimal allocation of other assets, such as physical capital.

This allocation will, in turn, determine firm boundaries and organizational

structure.

In addition, treating information as an asset allows us to treat

endogenously the question of whether it should be created in an

alienable or inalienable form. After all, in many cases, information,

knowledge and skills can be embodied either in humans or in tradable

commodities like software or databases. What are the costs and

benefits of alternative strategies and the implications for organizational

structure? What is the value of making information alienable?

Finally, by assuming that the synergies between agents occur only

through the assets (which now include information) that they have

access to, we can simplify the notation by suppressing the explicit

reference to the coalition of other agents. In addition, to simplify

notation, we also suppress the vector of actions, x:

![]()

Note that in this framework, actions x do not directly create

or change the value of assets, but access to assets can affect

the value of actions.

3. Information and organizational structure

Explicitly treating information as an asset, the framework can

now be applied to a number of questions regarding the relationship

among information, technology and organizations.

3.1 How does the location of information affect incentives and ownership structure?

In the first case I examine, consider an entrepreneur who has

some expertise needed to run a firm. For simplicity, assume that

the only relevant assets are the information in the entrepreneur's

head, labeled ![]() , and the physical assets

of the firm,

, and the physical assets

of the firm, ![]() . No value can be created without

access to both of these assets. In addition, assume that the assets

are complementary in that the information is of no value without

access to the firm, and that firm is of no value without access

to the entrepreneur's expertise. [4]If no comprehensive contract

can be written regarding the disposition of the firm in each possible

future contingency, should the entrepreneur or some other agent

own the firm? The framework can be readily applied to answer this

question.

. No value can be created without

access to both of these assets. In addition, assume that the assets

are complementary in that the information is of no value without

access to the firm, and that firm is of no value without access

to the entrepreneur's expertise. [4]If no comprehensive contract

can be written regarding the disposition of the firm in each possible

future contingency, should the entrepreneur or some other agent

own the firm? The framework can be readily applied to answer this

question.

First, consider the case in which someone other than the entrepreneur

owns the firm, ![]() . In this case, if the entrepreneur

makes an investment of effort and creates some potential value,

he can be subjected to a hold-up by the other party, since he

needs access to

. In this case, if the entrepreneur

makes an investment of effort and creates some potential value,

he can be subjected to a hold-up by the other party, since he

needs access to ![]() in order to realize that

value. [5]By assumption, no contract for the use of

in order to realize that

value. [5]By assumption, no contract for the use of ![]() exists, so the parties must bargain for the division of the surplus.

Under Nash bargaining, each party can expect to get 1/2 of the

additional value created (this is their Shapley value). Similarly,

if the other party creates some value, the entrepreneur can bargain

for 1/2 of the value created by threatening to withhold his expertise,

exists, so the parties must bargain for the division of the surplus.

Under Nash bargaining, each party can expect to get 1/2 of the

additional value created (this is their Shapley value). Similarly,

if the other party creates some value, the entrepreneur can bargain

for 1/2 of the value created by threatening to withhold his expertise,

![]() otherwise. Each agent will exert effort

until the marginal benefit he can expect to receive is just equal

to the marginal cost of the action he takes. Since each party

will bear the full costs of their efforts but can only expect

to receive 1/2 of the incremental value created, they will both

underinvest in this ownership arrangement.

otherwise. Each agent will exert effort

until the marginal benefit he can expect to receive is just equal

to the marginal cost of the action he takes. Since each party

will bear the full costs of their efforts but can only expect

to receive 1/2 of the incremental value created, they will both

underinvest in this ownership arrangement.

Formally, the first order conditions are given by the following

equations where the entrepreneur and the other party are indexed

by {1,2}, respectively.

Because the information and physical assets of the firm are productive

only when used together, then the second term in both equation

4a and equation 4b is equal to zero, so each party will only invest

in effort to the point at which marginal costs are equal to 1/2

of marginal value.

Alternatively, consider giving the entrepreneur ownership of the

firm, ![]() (as well as "ownership"

of his expertise,

(as well as "ownership"

of his expertise, ![]() ). In this case, the other

party cannot hold up the entrepreneur, since the entrepreneur

already controls all the assets needed. While the entrepreneur's

incentives are improved, the other party's incentives are unaffected,

since as before, the entrepreneur can bargain for 1/2 of the value

created by other party's investments in the relationship.[7]

). In this case, the other

party cannot hold up the entrepreneur, since the entrepreneur

already controls all the assets needed. While the entrepreneur's

incentives are improved, the other party's incentives are unaffected,

since as before, the entrepreneur can bargain for 1/2 of the value

created by other party's investments in the relationship.[7]

Net benefits will be maximized by providing the strongest [8] incentives

for effort on the part of each agent. The organizational problem

can thus be viewed as a matter of choosing among the feasible

allocations of asset ownership one that maximizes the share of

value that each party can expect to receive. Thus, incentive considerations

prescribe that it is optimal to give the entrepreneur ownership

of the physical assets of the firm as long as he has information

that is essential to its productivity anyway. Other considerations,

such as wealth constraints and credit constraints may limit the

feasibility of such an allocation. Nevertheless, from an incentive

standpoint, the informed agent should be given ownership of the

assets necessary to his work.

It is worth interpreting this result in terms of Hart and Moore

(1990). In one sense, it could be considered an application of

their proposition 6, that an agent who is "indispensable"

to an asset should own that asset. Because the agent in the preceding

example has information essential to the productivity of the physical

asset, he is effectively "indispensable" by their definition.

Given our treatment of information as an asset that is necessary

to the productivity of the physical assets, they can appropriately

be thought of as complementary assets. This suggests that Hart

and Moore's proposition 8 is even more germane: complementary

assets should be owned by the same agent when complete contracts

are infeasible.

If the entrepreneur's information is not completely essential

to the productivity of the physical assets, then giving him ownership

of them will reduce the incentives of the other agent[9]. Whether

this is outweighed by the improved incentives to the informed

agent will be a function of how necessary that agent's information

is to the productivity of the firm and how important it is to

maximize his incentives relative to those of the other agent.

An analysis of the first order conditions under alternative ownership

structures show that the more important it is to provide incentives

to the informed agent, the more likely it is that it will be optimal

to give him ownership. Furthermore, to the extent that it is particularly

difficult to prespecify the outputs for "information work",

it is likely that informed agents will have significant, uncontractible

actions.

Hart and Moore also present an argument suggesting that the ownership

of assets essential to production is likely to give the owner

"authority" over other agents that need access to those

assets. Without reproducing their argument, this suggests that

a corollary to the proposition that informed agents should own

the essential assets is that they are also likely to gain authority

over uninformed agents.

The above analysis helps explain why an entrepreneur, with information

essential to the success of the firm, is more likely to own the

firm than are other people who work inside or outside the firm.

Similarly, if a key individual, such as a research scientist or

a star salesperson is critical to the success of a new venture,

the venture capitalist is likely to insist that that individual

be given an ownership stake in the firm. This will tend to improve

the key individual's incentives without reducing those of other

parties proportionately.

The analysis also suggests an important exception to this principle:

when a key individual's actions are entirely contractible, incentives

can be provided via a contract and ownership of the firm is not

needed. For instance, when there is a well-defined product, market

and distribution channel, the incentives of a star salesperson

may be adequately provided by a commission-based sales contract.

Likewise, a patent may be sufficiently complete that additional

incentives for an inventor are not needed. Management contracts

in which top executives have no ownership stake in the firm are

particularly unlikely to be sufficient in the early stages of

a venture, but pose less of a problem for mature firms. One explanation

for the boom in management buy-outs in the 1980s is that the turbulent

business environment provided new opportunities for managers to

profitably apply knowledge in unforeseen ways. Given incomplete

contracts, the incentives are much greater for an individual who

owns a newly spun-off company than they are when the same individual

is a head of an equivalent division owned by others.

A second implication of the above analysis is that ownership of

the physical assets of the firm, aF, may be

of little value when complementary information assets, aI,

are not also controlled. By definition, the purchaser of a firm

only gets control of the alienable assets owned by the firm, in

this case, aF. Therefore, for a "knowledge-based"

firm, such as a consulting firm, or a research firm dependent

on a few research scientists, ownership of the physical assets

of the firm may have little value. The purchaser may still have

to share profits with the key individuals who remain in control

of the essential information assets. Thus, an empirically-testable

prediction of the framework is that, a potential purchaser will

pay much less for a knowledge-based firm than a traditional firm

with a comparable earnings record. Ironically, a knowledgeable

entrepreneur may be unable to "cash out" unless a way

is found to make the firm independent of the inalienable expertise

of the key individuals.

This explanation for why knowledge goes hand in hand with ownership

is distinct from, but complementary to, that of Rabin (1993) ,

which also models the relationship between information, ownership,

and authority. Instead of examining the incentives of the informed

agent to maximize uncontractible effort as is done above (a moral

hazard problem), Rabin showed that the adverse selection problem

could also be sufficiently severe that, in certain equilibria,

an informed agent could only "prove" the value of his

information by taking control of the firm and its residual income

stream. This leads to the informed agent getting authority over

the uninformed agent. Both these considerations may be relevant

in some situations. For instance, venture capitalists often insist

that an informed entrepreneur hold a significant stake in a new

venture, both as a signal of his own faith in the project (self

selection) and as a motivator to get him to work hard (moral hazard).

3.2 What is the impact of making information alienable or contractible?

Explicitly treating information as an asset as modeled above,

not only makes it possible to consider whether an informed party

(agent 1) should own the firm instead of another party (agent

2), it also makes it natural to consider a third alternative:

giving the other party "ownership" of both the physical

assets and the information. Of course, this requires that the

information can be made "alienable" for instance in

the form of an expert system, a procedures manual or some other

artifact. In certain circumstances, it may be more efficient to

move the information than to shift ownership of all the physical

assets to the informed agent.

Given agent 2 ownership of both the information, aI, and the other assets of the firm, aF, yields the following first order conditions:

| [10] |

Now the incentives of agent 2 are maximized at the expense of

agent 1. This will provide incentives that are superior to those

under agent 1's ownership if the actions of agent 2 are relatively

important.

However, there are a number of reasons that it may be difficult

to transfer the information "asset" to agent 2 (Brynjolfsson,

1990a). Most notably, the reason for hiring an agent in the first

place is often to reduce some of the information processing load

on the principal. Furthermore, the relevant information may be

generated by the hired agent in the course of his activities,

as in learning-by-doing, or simply by what Hayek (1945) calls

the "knowledge of the particular circumstances of time and

place". This information may be costly to convey to the agent

2, not only because of difficulties in codifying and transmitting

it, but also because of adverse selection problems. It is notably

difficult to consummate transactions when the parties have differential

information because of the "fundamental paradox" of

information: "its value for the purchaser is not known until

he has the information, but then he has in effect acquired it

without cost" (Arrow, 1971, p. 152).

When, for whatever reason, the information asset cannot be owned

by agent 2, yet it is necessary to the productivity of the physical

assets, the incentive considerations featured in the preceding

analysis suggest that the next best solution will generally be

to give ownership of the physical assets to the informed agent.

In the absence of contractibility, complementary assets should

be owned by the same party, and in this case, this requires moving

control of the alienable physical assets to the owner of the inalienable

information asset. Thus, the control of information can determine

the equilibrium ownership of other assets as well, and therefore

organizational structure and authority.

In addition, this framework also suggests a method of quantifying

the potential improvement in incentives, and therefore increase

in value, enabled by making information alienable. Compare the

output created under the best possible ownership structure when

information is alienable (the unconstrained allocation) to the

output created under the best possible ownership structure when

information must be "owned" by a particular party (the

constrained allocation). In above case, this would amount to comparing

the maximum value created when choosing an organizational arrangement

described by equations 4, 5 or 6, with the maximum attainable

when the choice is limited to equations 4 or 5. Obviously, the

ownership of even the alienable assets may be shifted by adding

the inalienability constraint to some assets. The difference between

the values created under these alternatives could be called the

"value of alienability". In some circumstances,

it can be quite large, suggesting that merely embodying information

in a tradable form can "create" a great deal of value

even without increasing the stock of knowledge.

The above analysis suggests that the definition of which assets

are alienable, and which are not, can be made endogenous. Incentives

for advancing technology in ways which make information alienable

will be strongest if the value of alienability is high. For instance,

to the extent that value is enhanced by embodying and delivering

expertise in the form of a knowledge-based expert system, such

knowledge engineering efforts are likely to be undertaken. Procedures

manuals, how-to books, lectures and other vehicles for purchasing

know-how have existed even longer.

A natural extension of this approach would be to empirically examine

the organizational effects of making expertise alienable through

software in areas like tax law or medicine, or through on-line

databases in a rapidly growing number of domains. More generally,

the reduction in information transmission costs enabled by information

technology is already leading to significant new approaches to

the related organizational problem of co-locating information

and decision rights (Brynjolfsson & Mendelson, 1993) .

When knowledge can be articulated, it is often straightforward

to embody it in an alienable artifact. However, this is may be

impossible for tacit knowledge (Williamson, 1979) , although some

knowledge may be transferred through tacit shared understandings

of collectives. [11] For instance, it might be fruitful to interpret

the organizational value of corporate cultures as a "technology"

which allowed information to be transferred at relatively low

cost, but only among parties which share the same culture. Languages

and even education could also be interpreted in this vein, simply

by considering the organizational value of enabling "semi-constrained"

allocations in which knowledge was alienable, but only among a

finite subset of agents.

In the past decade, the digital revolution has led to the creation

of numerous alienable information assets. The model predicts that

the primary financial beneficiaries will be those who own the

information assets but who formerly could not benefit from them

without being personally involved. Indeed, the relative incomes

of high-skill "superstars" in several fields may be

a reflection of this phenomena (Levy & Murnane, 1992). The

embodied information need not be limited to "knowledge"

in the traditional sense. Consider the relative incomes of popular

musicians and other artists today who are able to embody their

work in various recording media.

The analysis above and in section 3.1 shows that incentives are

improved by having the control of both information assets and

complementary physical assets vested in the same party. Separating

control leads to potential hold up problems. However, relaxing

the underlying assumption that no comprehensive contract can be

written changes this conclusion. As Williamson (1985) has argued,

complementary assets will only lead to integration when there

is "market failure", that is the breakdown of arm's

length contracting. Above, it was argued that this will make it

difficult to contractually transfer information from party to

another. It will also make it difficult to specify its application

even if it is not transferred. In fact, Teece (1980) argued that

the existence of "knowhow" is a key determinant of integration

because "a knowhow agreement ...will be highly incomplete,

and the failure to reach a comprehensive agreement may give rise

to dissatisfaction during execution." However, some information

is fairly contractible, such as the control algorithms of an robotic

assembly line. Trends in technology, and in intellectual property

law suggest that more information may fall into this category.

What are the organizational and efficiency implications of making

information contractible?

If information is fully contractible, then there are no "residual

rights" so the ownership of it is irrelevant. The same party

who owns physical assets does not need to control the complementary

information because there is no longer a holdup problem. Thus,

even more ownership arrangements become feasible. For instance,

as operating system software became more standardized in the late

1960s, IBM stopped bundling it with their mainframes. More recently,

the trend toward information system outsourcing is consistent

with an improved ability to define outputs and inputs contractually.

Making information alienable improved incentives by making new

ownership patterns feasible, but it still fell short of the first

best since any party not getting control of the information asset

was potentially subject to being held up. In contrast, making

information fully contractible could potentially give every party

the optimal incentives, at least with regard to this asset. In

principle, access to the information asset can be allocated to

each individual based on the appropriate contingencies that will

maximize their incentives. As with alienability, one can compare

the value created when information is contractible with the value

created when information is not. It is likely that in many cases

this will indicate that the "value of contractibility"

can be extremely high. I will not venture to speculate whether

America's growing legal profession is helping in this regard,

but moves towards greater standardization and better defined intellectual

property rights do seem to fall into this category.

3.3 Do smaller firms provide better incentives for exploiting information?

The analysis above considered just one "information"

asset and showed that the physical assets should be owned by the

same person who has the information necessary to the productivity

of those assets.

The possibilities become more interesting when there are multiple,

informed agents. Consider the case of n agents (i = 1...n), each

of whom has some information (ai, i = 1 ...n) which requires access

to a physical asset (the "firm": ![]() ),

to be productive. Assume that the information of one agent does

not affect the information of other agents.

),

to be productive. Assume that the information of one agent does

not affect the information of other agents.

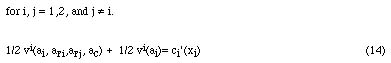

If any one agent, j, is given ownership of the physical asset,

his first order condition is:

Regardless of which agent owns the physical asset, all

the other agents in the firm will have insufficient incentives

to exert effort. To the extent that these insufficient incentives

will lead them to underutilize their information, overall productivity

would be enhanced if the same agent could own all the information

and the physical asset of the firm. This is consistent with the

notion of providing all the necessary information to the running

of the firm to an owner/manager. The owner/manager has the information

and the first-best incentives, while the other agents simply carry

out his instructions, with little information or physical asset

ownership of their own. Because their uncontractible actions

are kept to a minimum, there is little need to provide them incentives

through ownership. This is in many ways consistent with the Taylorist

prescription that enables the creation of large, successful hierarchical

firms.

An interesting alternative to single agent ownership is to have

a partnership, as many professional firms do, in which control

of the physical assets is allocated on the basis of majority rule.

In this case, the agent will effectively control the firm whenever

he is in the majority coalition, so assuming random coalitions

on any given issue, his first order condition (for n odd) is:

![]()

This system will more evenly allocate the incentives of all the

agents. However, they will still have insufficient incentives

to invest compared to the first-best, especially as n becomes

large.

The problem of insufficient incentives for the informed agents

cannot be solved by any combination of voting patterns because

there is simply not enough residual income to go around. The first

best incentives require that on the margin, each agent receive

100% of his contribution, but this is not possible if only total

output is observed and budget balance is to be maintained (Alchian

& Demsetz, 1972). This brings us back to the assumption made

at the beginning of this section that all actions were not contractible.

There is clearly a strong benefit to setting up production so

that actions are contractible. That way, ownership does not have

to bear the (impossible) burden of providing incentives for all

the agents. Firms obviously do try to regiment production in ways

that facilitate this, sometimes at the expense of creative freedom

(Holmstrom, 1989).

One can see that small firms are likely to have an advantage in

providing incentives, not only because it is likely to be easier

to separate out and contractually reward the individual contributions,

but also because agents in smaller firms will have stronger incentives

to make the uncontractible contributions as well. [12] For instance,

equation (8) indicates that small partnerships will provide stronger

incentives than large ones; proprietorships provide the best incentives

of all. When it is important to provide incentives for the application

of information in ways that cannot be easily foreseen and incorporated

into a contract, small firms will have a relative advantage over

large firms.

One example is that partnerships such as law firms have traditionally

been fairly small compared to corporations. It is interesting

to note that in the 1980s some law firms grew to over 200 partners

(Labaton, 1990), which would seem to be beyond the size consistent

with equation 8. One explanation is that these firms can more

accurately apportion revenues and costs through explicit

contracts by using computers to track billing and asset use on

an individual basis. In this sense, the uncontractible "community

property" is minimized and the partnership functions more

like a conglomerate of individual entrepreneurs, each with his

or her own "turf". The growing numbers of non-equity

"partners" (Aoki, 1990) is also consistent with the

idea that control of non-human assets is no longer of such central

importance in large law firms because uncontractible contingencies

have been reduced.

3.4 Are flexible assets more appropriate for informed agents?

The inefficiencies inherent in having multiple informed agents

working in the same firm, whether the firm is owned by one of

the agents or a partnership, can be alleviated if each of the

agents could have uncontested ownership of, and therefore access

to, the physical assets of the firm.

If the physical assets of the firm are not unique, and if there

are no economies of scale in their use, then the first best incentives

for all of the informed agents can be costlessly achieved by giving

each of them his or her own firm (that is, an ![]() asset for each agent with an ai asset, as in equation 7).

asset for each agent with an ai asset, as in equation 7).

Alternatively, the assets of the firm may be divisible to some

extent. In this case, agent i may not need access to all of the

physical assets that comprise the firm, but only some subset,

![]() i. Then there will be

a trade-off between distributing the assets of the firm to its

agents or keeping the assets together. To the extent that the

firm's assets are complementary, dividing ownership of the assets

will reduce their productivity in those coalitions in which they

were separated. On the other hand, if each agent's information,

ai, were particularly synergistic with only the subset

i. Then there will be

a trade-off between distributing the assets of the firm to its

agents or keeping the assets together. To the extent that the

firm's assets are complementary, dividing ownership of the assets

will reduce their productivity in those coalitions in which they

were separated. On the other hand, if each agent's information,

ai, were particularly synergistic with only the subset ![]() i,

then there are advantages to giving that agent ownership, so that

they would always be together.

i,

then there are advantages to giving that agent ownership, so that

they would always be together.

As an example, consider the case of three agents and three physical

assets of the firm, where synergies exist among the firm's assets,

and between each agent's information and the firm's assets.

When agent i owns the subset of physical assets ![]() i,

(and of course his private information, ai,)

the first order condition for agent 1 is:[13]

i,

(and of course his private information, ai,)

the first order condition for agent 1 is:[13]

![]()

Alternatively, if all the assets of the firm are owned by another

agent, agent 1's first order condition is:

![]()

The first order conditions for each of the other agents will be

symmetrical.

The ownership structure that provides the greatest incentives

to an agent can be determined by comparing the left hand sides

of the two equations. If the assets are highly or strictly complementary,

then the second, third and fourth terms of the first equation

will be low or zero. In this case, dividing the assets will provide

lower incentives than keeping them together, even for an agent

who is not the owner of the united assets. On the other hand,

if the information ![]() 1 applies mainly to the

physical asset aF1, and they are fairly productive

even when separated from

1 applies mainly to the

physical asset aF1, and they are fairly productive

even when separated from ![]() 2 and

2 and ![]() 3,

then the first equation shows that separate ownership provides

close to the first best incentives for the agent.[14]

3,

then the first equation shows that separate ownership provides

close to the first best incentives for the agent.[14]

The fact that there are several agents, each of whom has an important

information asset, ai, that requires access to the physical assets

of the firm to be productive means that first-best efficiency

cannot be achieved by organizing as a single firm, as shown in

equation 10. Therefore, where information technology results in

a decentralizing of information, it opens the door to a parallel

effect of decentralization of asset ownership, that is in an increased

use of markets to coordinate economic activity.

Moreover, the preceding discussion also highlights the importance

of the asset specificity of the physical assets in the integration/non-integration

trade-off. If information technology makes assets more flexible,

so that they are not as locked-in to other particular assets,

then it will facilitate the decentralization of asset ownership.

This is essentially the argument of Malone and colleagues (Malone,

Yates & Benjamin, 1987; Brynjolfsson, Malone & Gurbaxani,

1988), among others. On the other hand, when the technology increases

lock-in, for instance because of network externalities, proprietary

standards or idiosyncratic hardware and software protocols, it

will make decentralization more costly.

Thus, technology will affect the organizational choices of the

firm both through its impact on the distribution of information

and by changing the nature of the non-human assets. These effects

interact with each other and feedback on themselves. The best

incentives can be achieved either 1) through the centralization

of information and asset ownership in one party, in which case

there is no cost to high asset specificity, or 2) through decentralization

of information and assets, which requires low asset specificity.

Thus, one would expect to see trends affecting the distribution

of information influence the types of physical assets used in

production, and vice versa.

One dramatic example is the way the rise of the personal computer

enabled thousands of small high technology startups to compete

successfully with bigger companies. In turn, the desires of knowledge

workers drove the shift from centralized computing to personal

workstations, even within large companies. The rise of automated,

knowledge-intensive steel mini-mills is another example of complementarities

between the distribution of information and the flexibility of

technology.

3.5 How does "coordination information" affect the distribution and ownership of production assets?

Up until now, we have only considered complementarities among

the physical assets or between information and physical assets,

not among the information assets themselves. Obviously, when there

are multiple informed agents working closely together, each of

them may need access to the information possessed by some other

agent at any given time. Such interactions can become exceedingly

complex, leading to combinatorial explosion and making explicit

contracts unworkable (Mailath & Postlewaite, 1989; Rosen,

1988). What's worse, if every agent truly depends on information

known only to other agents, then no rearrangement of the physical

assets alone can eliminate this interdependency. There will always

be insufficient incentives comparable to those of when complementary

physical assets are owned by separate agents (e.g. equation 9).

However, one way to reduce the number of necessary links between

agents is to channel all interactions through a central "coordinator"

(Malone & Smith, 1988). In this way, instead of each n agents

having to communicate and coordinate with n-1 other agents (for

a total of n.(n-1) links), each agent only

has to send and receive information from one coordinator (for

a total of n links). Obviously, relying on a central coordinator

can be vastly cheaper, and when bandwidth or time available for

communication is limited, results in better coordination. Diverse

organizations such as factory production lines and military operations,

which require tight coordination among members in limited time,

are often structured so that coordination is based on centralized

instruction rather than negotiation among agents. While the costs

of delay and bandwidth can be intangible when the links refer

to communication, a similar principle applies to transportation,

where the costs are more explicit. For instance, the idea of using

a hub-and-spoke network is clearly a principle of efficiency that

enables Federal Express, and increasingly passenger airlines as

well, to economize on air routes.

When centralized coordination is required, it is often, but not

always, carried out within firms rather than among them. While

others have simply assumed that centralized coordination is synonymous

with firms, one can demonstrate that such an arrangement follows

from weaker assumptions about assets and incentives. Below, I

show that the existence of one agent who has essential coordination

information has interesting implications for the distribution

of physical assets. In particular, it can make centralized ownership

of all physical assets optimal if either 1) it is important to

provide incentives to the "coordinator" or 2) the physical

assets are even weakly complementary. Each of these cases is analyzed

below.

To analyze the first case, consider the following stylized model

of centralized coordination. Instead of each agent being able

to contact the other agents directly, assume that they can only

communicate with a central "coordinator".[15] Because of

his positioning, the central coordinator obtains information that

is essential to the productivity of the agents. [16]This set-up reduces

the total number of links that need to be maintained, but also

makes the agents very dependent on the central coordinator. Formally,

assume that the typical agent needs access to the coordination

information, ac, to be productive, but that

the information of any given agent is irrelevant to the coordinator

or the other agents directly. Assume further that the productivity

of any agent, i, is enhanced when he has access to certain physical

assets, ![]() i, but is independent

of other assets,

i, but is independent

of other assets, ![]() j,

j

j,

j![]() i .[17]

i .[17]

When each of the agents owns some physical assets (and his information,

ai), the first order condition for a typical agent is:[18]

![]()

When the central coordinator owns all the physical assets, then

agent i's first order condition is:

![]()

Because the agent needs access to the coordination information,

the second term in each equation is equal to zero, so the incentives

for a typical agent do not change under alternative ownership

structures. However, the incentives for the coordinator are unambiguously

improved by giving the coordinator ownership of all the physical

assets, even if they only increase his productivity marginally.

Thus, if it is important to provide incentives to the central

coordinator, centralized ownership is optimal.

The second case in which shifting ownership of non-human assets

from one agent to the coordinator is optimal is when the physical

assets are at least weakly complementary. Interestingly, in this

case giving the central coordinator all the assets is optimal

even when the effect on the coordinator's incentives is unimportant

or disregarded. The reason is that shifting such assets from any

agent i to the coordinator will enhance the incentives of the

other agents, (j ![]() i).

i).

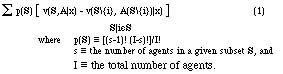

For tractability, consider the case of just two agents (i = 1,2)

and a coordinator (c) in which the two agents each own a physical

asset, ![]() i and each has

some valuable information, ai. Unlike the previous case, we now

assume that the physical assets

i and each has

some valuable information, ai. Unlike the previous case, we now

assume that the physical assets ![]() 1

and

1

and ![]() 2 are weakly complementary

with each other. In this case, each agent's first order condition

is given by:

2 are weakly complementary

with each other. In this case, each agent's first order condition

is given by:

![]()

Alternatively, if both the physical assets of the firm are owned

by the central coordinator, each agent's first order condition

is:

Under the assumption that each agent needs access to the central

coordinator's information to be productive, the third and fourth

terms of equation (13) are zero, as is the second term of equation

(14). If the physical assets ![]() i

and

i

and ![]() j are even weakly

complementary, then the two remaining terms will sum to less than

1/2 vi(ai,

j are even weakly

complementary, then the two remaining terms will sum to less than

1/2 vi(ai, ![]() i,

i,![]() j,

ac), but this is precisely the incentive that the agent would

get under centralized asset ownership (equation (14)).

j,

ac), but this is precisely the incentive that the agent would

get under centralized asset ownership (equation (14)).

Thus when there is a need for centralized coordination, all agents'

incentives are improved by having ownership of assets also centralized.

In other words, centralized coordination is more efficiently

carried out in firms than in markets. Conversely, if coordination

directly between the agents becomes feasible, then the need for

centralized coordination and centralized asset ownership is diminished.

The idea of thinking of the firm primarily in terms of its coordination

function has received much attention (Mailath & Postlewaite,

1989; Malone, 1987; Rosen, 1988) but it has been difficult to

derive the link between coordination structures and asset ownership.

Treating information, and particularly coordination information,

as an asset and employing the property rights approach may be

a beginning for such a theory, but clearly much work still needs

to be done to understand and formalize the concept of coordination

information as an "asset".

There have been significant changes in the way economic activity

has been organized since the inception of large scale investment

in information technologies like computers. Researchers have found

both empirical and theoretical support for a relationship between

these two phenomena. In this paper, I add to this research by

showing how the property-rights approach to the nature of the

firm can provide insight into the mechanisms by which information

technology influences organizational structure.

The models indicate that information technology will result in reduced integration and smaller firms to the extent that it:

1) leads to better informed workers, who need incentives,

2) enables more flexibility and less lock-in in the use of physical assets, and

3) allows direct coordination among agents, reducing the need

for centralized coordination.

On the other hand, the framework suggests that more integration will result from information technology where:

1) network externalities or informational economies of scale support the centralized ownership of assets and

2) it facilitates the monitoring, and thus contractibility, of

agent's actions.

More than one of these phenomena may be important in any given

case.

4.2 Comparison with empirical evidence

There has only recently been large sample econometric analysis

showing that information technology is broadly correlated with

significant reductions in vertical integration and firm size (Brynjolfsson,

Malone, Gurbaxani et al., 1991a). While one can infer from this

that one or more of the first three mechanisms discussed above

is especially relevant empirically, the framework introduced in

this paper provides a basis for more specific hypothesis testing.

For instance, where the technology has lead to an increase in

the average skill level of employed workers by augmenting the

demand for workers with more education relative to those who do

routine jobs, the framework predicts a decline in firm size, ceteris

paribus. Because information technology has been found to be broadly

correlated with increased demand for more educated workers relative

to less educated workers, the framework suggests that this may

be a mechanism by which information technology leads to a general

decline in firm size.

At the same time, by highlighting the link between uncontractible

actions and the use of ownership to provide incentives, the framework

can also help explain cases in the other direction. The example

of law firms discussed in section 3.3 is one such example.

It should also be possible to examine other predictions of the

framework. For instance, the network externalities and economies

of scale inherent in ATM's and large databases, respectively,

should lead to increased integration in the banking industry.

Increased flexibility of physical assets, like robots, should

make it possible to decouple some manufacturing plants from one

another. Where technology reduces the need for centralized coordination,

it should also be associated with the more decentralized asset

ownership, as in value-adding partnerships and markets coordinated

through interorganizational information systems.

4.3 Comparison with related literature

The findings of this paper are broadly consistent with three related

strains of literature, but also build on their conclusions. Below,

I compare the results of this paper with previous applications

of 1) transaction costs literature, 2) coordination theory, and

3) the Grossman-Hart-Moore approach to property rights.

The transaction costs literature pioneered by Williamson (1985)

has been invoked to explain the recent shift from hierarchies

to markets (Malone, Yates & Benjamin, 1987; Brynjolfsson,

Malone & Gurbaxani, 1988). The basic result of this literature,

that as information technology reduces asset specificity it facilitates

de-integration, is supported and formalized in a model presented

in this paper. However, a second aspect of the Williamsonian credo

is not supported. The transaction cost approach posits that market

failure leads to increased integration and that markets break

down when it is difficult to write complete contracts (because

of bounded rationality combined with complexity and uncertainty,

according to Williamson). This suggests that the shift to markets

associated with the introduction of information technology is

a signal of an increased ability of firms to write complete, contingent

contracts with agents. [19] Unfortunately, field studies indicate that

top management in the most organizations of the 1980s have actually

been writing less detailed contracts with employees and

suppliers than in earlier eras (Kanter, 1989; Piore, 1989). The

increased knowledge and flexibility of agents and the increasingly

volatile environment has apparently outstripped any improvements

in management's bounded rationality.

Although one could argue that, even if this is true, transaction

costs are still reduced on balance because of the increased flexibility

of assets discussed above, the analysis presented in section 3.2

suggests an alternative explanation. The extent to which an agent's

actions are contractible does not by itself determine organizational

structure, rather it is the interaction of contractibility with

the need to provide incentives via asset ownership that defines

the costs and benefits of market coordination. In fact, it is

precisely the party whose actions are least contractible who is

most in need of asset ownership to provide, and make credible,

the right incentives. Thus, if information technology has led

to more decentralized asset ownership by affecting contractibility,

it has done so either by 1) reducing the contractibility of the

agent's actions, or 2) increasing the contractibility of the principal's

actions. Either of these effects would make it more important

to provide agents with asset ownership, which means using market

coordination. In contrast to the transaction cost approach, this

analysis indicates that a technology that leads to a general increase

in contractibility will not by itself lead to increased use of

markets. Indeed, if complete, contingent contracts could be written

for all actions, there would be no "residual" rights

and thus ownership and the concept of "firms" vs. "markets"

would be meaningless.

Malone (1987) has pioneered a theory of coordination that formally

distinguishes organizations by their costs of coordination, production,

and vulnerability. A basic result of this literature is that centralized

structures can economize on the costs of coordination, at the

expense of production and vulnerability costs. Malone and Smith

(1988) argue that many of the historical changes in the dominant

organizational structures of the economy can be explained by changes

in technology and the environment that increased the relative

importance of economizing on coordination costs. They also suggest

that less centralized coordination mechanisms will come to dominate

as information technology reduces coordination costs and speculate

that this will reverse the historical trend toward larger firms.

While their models show that centralized coordination can theoretically

take place either within firms or through "brokered"

markets, the model presented in section 3.5 provides a way of

distinguishing the circumstances under which each ownership structure

will dominate. Indeed, it suggests that in the presence of incomplete

contracts, most centralized coordination will optimally take place

within firms (that is, under centralized asset ownership). Only

when 1) the central coordinator's job is well-defined enough that

he can be provided with incentives through a relatively complete

contract, and 2) the goods and services being coordinated are

not too complementary, will markets (distributed asset ownership)

be optimal. These conditions seem likely to hold for financial

brokers and commodities trading, but are less descriptive of CEOs

or manufacturing activities. The approach taken in this paper

formally links centralized coordination in the latter sorts of

cases with firms, and is thus is a natural extension of earlier

work in coordination theory.[20]

4.3.3 The Grossman-Hart-Moore approach to property rights

Finally, the Grossman-Hart-Moore property rights approach to identifying

the determinants of integration and organizational structure has

enjoyed increasing success and recognition from theoreticians,

and was obviously central to the analysis presented in this paper.

This theory exposes the role of non-human assets in affecting

the incentives of agents, but does not presume to explain from

whence the need for incentives arises. While it shows the importance

of giving ownership of essential assets to the those agents that

have important non-contractible actions, the theory by itself

is not sufficient to enable predictions about whether information

technology would be expected to lead to greater use of firms or

markets. For instance, (Piore, 1989) considered applying the property

rights framework, and although he found it provided some valuable

insights, he concluded:

The ability of this model to assimilate the recent corporate changes

[is] more limited than it appears. The critical outcomes ultimately

depend in the model upon the location of the information required

to make decisions which are expensive to anticipate, and the model

itself does not tell you where that information is located. For

that one must ultimately turn to a production (or technologically)

based theory.

In a previous paper (Brynjolfsson, 1990a), I showed how information

technology can, and has, led to a broader distribution of information

in many organizations and how this has affected the need for incentives.

The analysis in this paper takes some additional steps towards

applying this prerequisite to applying the property rights based

approach. While there is no technological inevitability in these

models, it is hoped that they do address Piore's call by

clarifying the mechanisms by which the changes in technology can

lead to commensurate changes in the dominant organization forms

in the economy.

The property rights framework of Grossman, Hart and Moore highlights

the central role of non-human assets because they can be bought

and sold as well as "owned". In this paper, I have treated

human assets, specifically the productive knowledge or information

of the agents, on an equal footing. The more explicit modeling

of the "information asset" facilitates the analysis

of organizations in which control of information, not physical

assets, is determinative.

The residual rights of control over who has access to the productive

information in an agent's brain may often be more important than

the residual rights associated with non-human assets which he

owns. For instance, the departure of key executives, deal-makers

or researcher (and their knowledge) may affect the other members

of the firm more than the loss of the lease to their building,

or even of their office equipment.[21] Consider the departure of Michael

Milken from Drexel, Burnham as a particularly disastrous example.

More colorfully, Reich (1990) has argued that Americans should

not be concerned that Bruce "Born-in-the-USA" Springsteen

now "works for the Japanese" (his record label has been

purchased by Sony). Applying the framework of section 3.1, indicates

that the essential asset of his trade, his human capital,

is still in American hands. It also validates Reich's contention

that investments in human capital play an especially important

role in determining the wealth of nations.

Instead of modeling only the alienable assets, I include inalienable

assets as well, but add the constraint that asset allocations

which separate inalienable [22]assets from their original "owners"

are not feasible. This approach may prove useful as the ranks

of knowledge workers and service workers grow, increasing the

need to model how incentives and organizational structure are

affected by the distribution of the residual rights associated

with both human and non-human assets. For instance, one immediate

implication of the inalienability of human assets is that, unlike

complementary physical assets, complementary human assets cannot

be centralized under the ownership of a single agent. This suggest

that incentive problems will be particularly severe in large,

knowledge-intensive enterprises.[23]

Happily, in most cases, the productivity of one agent's information

does not depend entirely on its synergies with the information

or physical assets controlled by other specific individuals. In

fact, when the information possessed by agents is not idiosyncratic,

an arrangement with close to optimum incentives can be achieved:

distributed, independently owned assets, giving each agent claim

to the non-contractible, residual income generated by his actions.

In this paper, I have shown that this explanation may be consistent

with the economy-wide growth of small firms and decline in vertical

integration. As information work has come to account for a dominant

share of labor costs, providing sufficient incentives for information

workers becomes increasingly important. In the absence of contractibility,

ownership may be the only way of providing such incentives.

At times, the recent restructuring of firms and industries appears

to have been as indiscriminate as it has been dramatic, underscoring

the need for better theory. Although models of how firms and markets

coordinate agents have progressed as much in the past ten years

as they did in the previous fifty, glaring gaps remain. Fortunately,

the opportunities for sharp, empirical tests enabled by the recent

changes in both the technology and superstructure of economic

organization give every reason to be optimistic about future advances

in our understanding.

Alchian, A. and H. Demsetz, Production, Information Costs, And

Economic Organization. American Economic Review, 62, (1972),

777-795.

Aoki, M. "The Participatory Generation of Information Rents

and the Theory of the Firm." in The Firm as a Nexus